暗号資産業界はまた新たな革新アプリケーションを迎えました。今回は金融貸出の分野です。報道によると、Divine Researchというサンフランシスコの貸出機関が暗号通貨の短期無担保ローン業務を開拓しており、昨年12月以来約3万件のローンを配布しています。

このビジネスの独自性は、その認証方法にあります。Divine Researchは、OpenAIのCEOサム・アルトマンが開発したWorld ID虹彩スキャンプラットフォームを使用して借り手の身元を確認します。この方法は、借り手がデフォルトした後に複数のアカウントを通じて責任を回避するのを効果的に防ぐだけでなく、従来の金融サービスがカバーしにくい海外の借り手に新しい選択肢を提供します。

Divine Researchは主に1000ドル以下の小額ローンをUSDCステーブルコインの形で配布しています。この革新的なモデルは、一般の人々が小額の信用を得る新しい道を切り開きました。同社の創業者Diego Estevezによると、彼らの借り手の群には高校の教師や小規模な商人などの一般の人々が含まれています。

この発展は、業界内で暗号資産が包括的金融分野での潜在能力についての議論を引き起こしました。この新しいタイプの貸付モデルは金融サービスが不足しているグループに機会をもたらしましたが、同時にその中に存在する可能性のあるリスクや規制の課題にも注

このビジネスの独自性は、その認証方法にあります。Divine Researchは、OpenAIのCEOサム・アルトマンが開発したWorld ID虹彩スキャンプラットフォームを使用して借り手の身元を確認します。この方法は、借り手がデフォルトした後に複数のアカウントを通じて責任を回避するのを効果的に防ぐだけでなく、従来の金融サービスがカバーしにくい海外の借り手に新しい選択肢を提供します。

Divine Researchは主に1000ドル以下の小額ローンをUSDCステーブルコインの形で配布しています。この革新的なモデルは、一般の人々が小額の信用を得る新しい道を切り開きました。同社の創業者Diego Estevezによると、彼らの借り手の群には高校の教師や小規模な商人などの一般の人々が含まれています。

この発展は、業界内で暗号資産が包括的金融分野での潜在能力についての議論を引き起こしました。この新しいタイプの貸付モデルは金融サービスが不足しているグループに機会をもたらしましたが、同時にその中に存在する可能性のあるリスクや規制の課題にも注

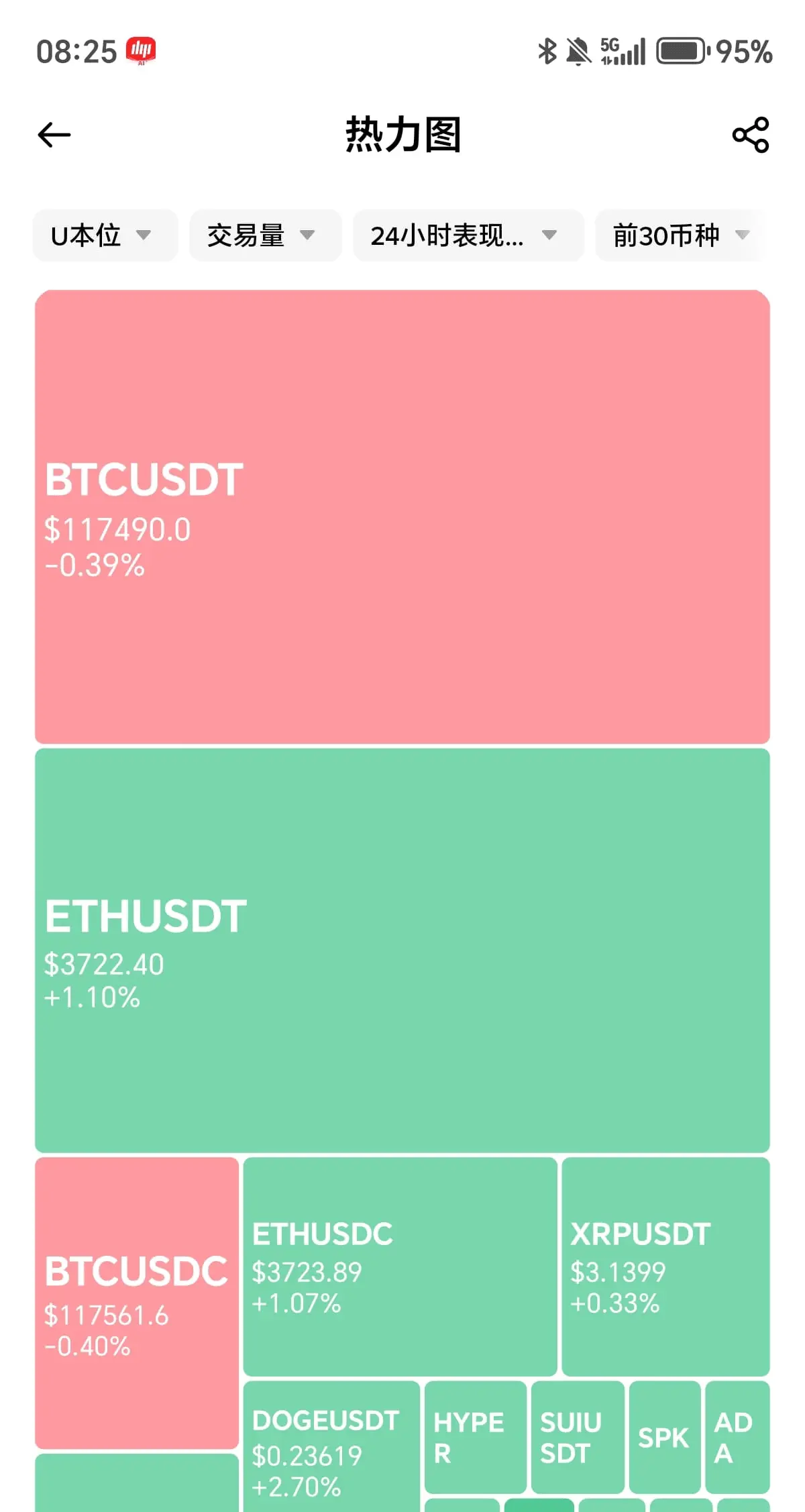

USDC-0.01%