ChenQingsong

No content yet

ChenQingsong

ETH has formed a Evening Star pattern, which is a bearish reversal pattern indicating that the market may shift from a rise to a fall, presenting certain short order opportunities.

The moving averages are in a bullish arrangement, and the price is above both the short-term and long-term moving averages, with the short-term trend still leaning towards bullish.

This is a certain resistance for short orders. If you want to short, you need to pay attention to whether the price will fall below the moving average support.

Suggestion: short order around 4300-4350, target 4000!

The moving averages are in a bullish arrangement, and the price is above both the short-term and long-term moving averages, with the short-term trend still leaning towards bullish.

This is a certain resistance for short orders. If you want to short, you need to pay attention to whether the price will fall below the moving average support.

Suggestion: short order around 4300-4350, target 4000!

ETH4.07%

- Reward

- like

- Comment

- Repost

- Share

ETH has formed a evening star pattern, which is a bearish reversal pattern indicating that the market may shift from rise to fall, presenting certain short order opportunities.

The moving averages are in a bullish arrangement, with the price above both the short-term and long-term moving averages, indicating that the short-term trend still leans towards bullish.

This is a certain resistance for short orders. If you want to short, you need to pay attention to whether the price will fall below the moving average support.

Suggestion: Short around 4000-4050, target 3800!

The moving averages are in a bullish arrangement, with the price above both the short-term and long-term moving averages, indicating that the short-term trend still leans towards bullish.

This is a certain resistance for short orders. If you want to short, you need to pay attention to whether the price will fall below the moving average support.

Suggestion: Short around 4000-4050, target 3800!

ETH4.07%

- Reward

- like

- Comment

- Repost

- Share

BTC, the big pancake in the early morning has also fulfilled a 1k space, the market is in a rapid pullback state, escaping from the peak short order has also captured a 1k space, do not attempt to buy the dip!

At the 4-hour level, a doji was previously formed in the morning below, with the price returning to run above the lower Bollinger Band, and a red 9 appeared below the TD indicator.

There are signs of a short-term rebound, but the overall RSI and MACD indicators still show that the market is in a downtrend, and it may continue to decline after the rebound.

Suggestion: Short around 118

At the 4-hour level, a doji was previously formed in the morning below, with the price returning to run above the lower Bollinger Band, and a red 9 appeared below the TD indicator.

There are signs of a short-term rebound, but the overall RSI and MACD indicators still show that the market is in a downtrend, and it may continue to decline after the rebound.

Suggestion: Short around 118

BTC-0.98%

- Reward

- like

- Comment

- Repost

- Share

BTC, Bit surged to 122450. If the daily chart peaks and falls below 120000 while stabilizing below, the probability of a short-term dip to the 116000 range increases. If this occurs, we still need to consider the pullback space!

The daily chart Bollinger Bands are opening, and multiple bearish candles have been consecutively formed, indicating that the bearish strength is dominant.

Suggestion: Short around 120000-120800, target 116000!

The daily chart Bollinger Bands are opening, and multiple bearish candles have been consecutively formed, indicating that the bearish strength is dominant.

Suggestion: Short around 120000-120800, target 116000!

BTC-0.98%

- Reward

- like

- Comment

- Repost

- Share

BNB and MACD, as important technical indicators, can effectively reveal price trends and momentum changes. Currently, the MACD red bars for BNB continue to show higher trade volumes, which is a strong proof that long positions are still active.

The continuous growth of the red bars indicates that long positions are strong, providing sufficient momentum for price increases. In the foreseeable short term, there is a high possibility that the price will maintain an upward trend.

Suggestion: Long positions near 810-805, target 820-830

The continuous growth of the red bars indicates that long positions are strong, providing sufficient momentum for price increases. In the foreseeable short term, there is a high possibility that the price will maintain an upward trend.

Suggestion: Long positions near 810-805, target 820-830

BNB1.22%

- Reward

- like

- Comment

- Repost

- Share

SOL, the 1-hour Candlestick Chart shows that SOL has recently experienced a rapid pump and continues to operate at high levels, with Trading Volume increasing alongside the rise, further validating the effectiveness of the upward trend, and long positions are actively participating.

Suggestion: Open long positions around 173-177, targeting the 185-190 range.

Suggestion: Open long positions around 173-177, targeting the 185-190 range.

SOL-0.7%

- Reward

- like

- Comment

- Repost

- Share

BTC has turned and twisted to astonishingly reach above 120,000, the power of the bull run cannot be underestimated, with a rise of nearly 10,000 points in just a few days!

However, at such a high position, finding a new high to escape at the top is the way to go; the space below is infinite, but how much more can we gain above?

Suggestion: Short 122800-123300, target around 118000!

However, at such a high position, finding a new high to escape at the top is the way to go; the space below is infinite, but how much more can we gain above?

Suggestion: Short 122800-123300, target around 118000!

BTC-0.98%

- Reward

- like

- Comment

- Repost

- Share

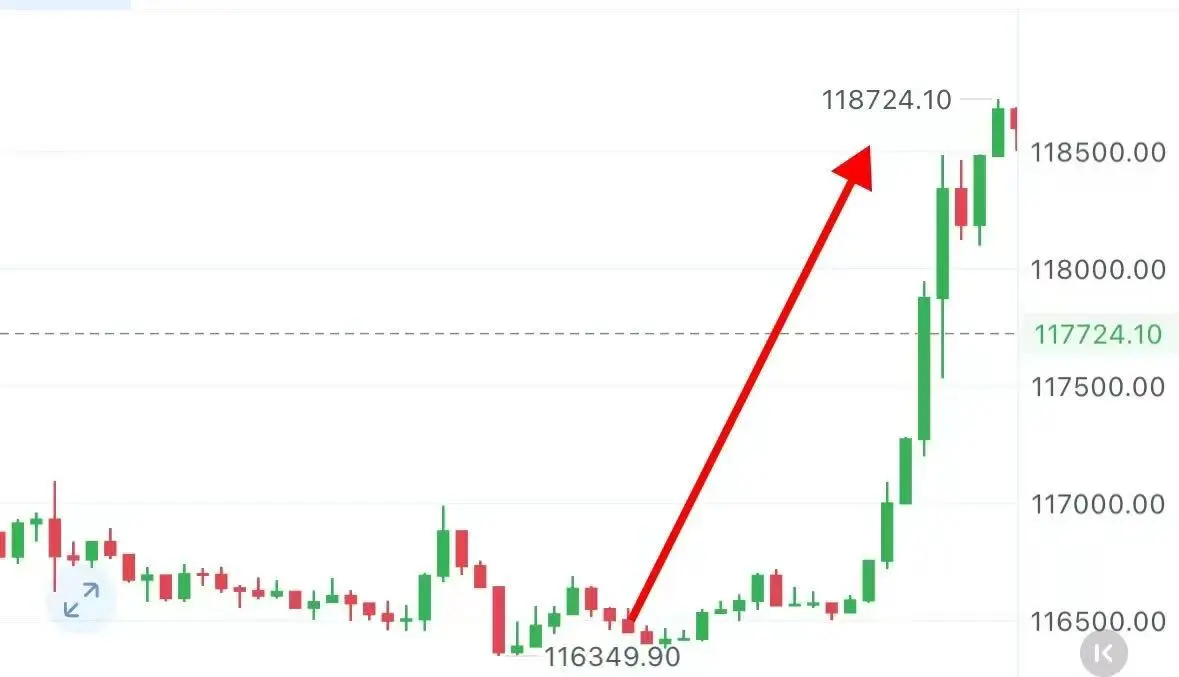

Bit has布局多 near 114000, looking at the target range of 116000-118000, the first and second target levels have all been reached!

This is the charm of medium to long-term investment! The layout is so precise and simple, and the strategy can be checked!

View Original

This is the charm of medium to long-term investment! The layout is so precise and simple, and the strategy can be checked!

- Reward

- like

- Comment

- Repost

- Share

In the evening, long order for Bit at 116600 entered the market, and the take profit for BTC at midday successfully gained 2000 points. This is the layout, this is the strength!

Who would have thought BTC would rise so much? I could! With Ethereum's surge being so strong, isn't it just simple for BTC to follow up with a thousand-point increase?

View Original

Who would have thought BTC would rise so much? I could! With Ethereum's surge being so strong, isn't it just simple for BTC to follow up with a thousand-point increase?

- Reward

- like

- Comment

- Repost

- Share

BTC, from an hourly perspective, the MACD histogram remains positive and gradually lengthens, indicating strong bullish trader strength; however, due to the lack of a clear trend, there is still uncertainty in the market direction.

The current price is fluctuating within the range, with support around 115600. If this area can hold strong support, the price may rebound and rise, and it may be worth considering going long.

Suggestion: Buy around 116200-115600, target 118000!

The current price is fluctuating within the range, with support around 115600. If this area can hold strong support, the price may rebound and rise, and it may be worth considering going long.

Suggestion: Buy around 116200-115600, target 118000!

BTC-0.98%

- Reward

- like

- Comment

- Repost

- Share

Ether is also strongly pumping as expected, reaching a high of 4010!

Enter long positions near 3887, exit at 3984 to capture nearly a hundred points of space! The trend is a testament to strength!

Enter long positions near 3887, exit at 3984 to capture nearly a hundred points of space! The trend is a testament to strength!

ETH4.07%

- Reward

- like

- Comment

- Repost

- Share

Bit midday public reminder that the pullback is still mainly bullish, trading hours pulled back as expected to around 116200 and pumped to a high of around 117200!

Another thousand-point space to cash in, and Ethereum is also surging straight up!

Another thousand-point space to cash in, and Ethereum is also surging straight up!

ETH4.07%

- Reward

- like

- Comment

- Repost

- Share

BTC reached a high near 117,600 in the early morning and then fell back to around 116,800. During trading hours, the main focus is still on pullbacks, but the long positions trend remains strong. Black Friday's big market movement is still in the evening U.S. stocks!

From the daily perspective, it is currently in the 116,300-120,900 oscillation range, the middle band of the Bollinger Bands has moved up to 116,500, and the price has previously stabilized above the middle band, establishing a short-term upward trend.

Although there has been a pullback subsequently, the overall upward trend has

From the daily perspective, it is currently in the 116,300-120,900 oscillation range, the middle band of the Bollinger Bands has moved up to 116,500, and the price has previously stabilized above the middle band, establishing a short-term upward trend.

Although there has been a pullback subsequently, the overall upward trend has

BTC-0.98%

- Reward

- like

- Comment

- Repost

- Share

Bit has been consistently suggesting a low long position, which reflects an understanding of the trend. By observing, one only needs to execute to grasp the market situation; this is a short-term analysis and control of the market!

You can be a novice and not understand market analysis, but you cannot deny the strength of Qingsong!

View Original

You can be a novice and not understand market analysis, but you cannot deny the strength of Qingsong!

- Reward

- like

- Comment

- Repost

- Share

In the morning, it's advisable to prepare for a pullback to around 114000 to go long, and the market subsequently cooperated very well to enter long positions near 114200.

In the afternoon, it surged to around 114800, directly gaining 600 points of space!

View Original

In the afternoon, it surged to around 114800, directly gaining 600 points of space!

- Reward

- like

- Comment

- Repost

- Share

August has arrived, and with the increasing expectations of interest rate cuts in September, many believe that this is a crucial window for mid-term positioning.

Many students have already withdrawn their funds multiple times, engaging in swing trading with the goal of achieving higher returns. From a capital allocation perspective, a swing trading amount of 30,000 to 50,000 is more suitable, while for short-term trading, 10,000 to 20,000 is advisable. Some opinions suggest that significant returns may be seen within 10 days.

View OriginalMany students have already withdrawn their funds multiple times, engaging in swing trading with the goal of achieving higher returns. From a capital allocation perspective, a swing trading amount of 30,000 to 50,000 is more suitable, while for short-term trading, 10,000 to 20,000 is advisable. Some opinions suggest that significant returns may be seen within 10 days.

- Reward

- 1

- Comment

- Repost

- Share

ETH, after rising to around 3700 in the evening, subsequently fell back to 3650 and rebounded upward to 3720, which proves that the short positions are weak, and the trading hours are still predominantly bullish!

Buy in batches at the two support levels below during the pullback. Aggressive traders can enter with a light position at 3600, while conservative traders should decisively go long at 3540!

Buy in batches at the two support levels below during the pullback. Aggressive traders can enter with a light position at 3600, while conservative traders should decisively go long at 3540!

ETH4.07%

- Reward

- like

- Comment

- Repost

- Share

BTC, after a strong pump to 115600 last night, consolidated and repaired, pulling back to 114700 in the early morning, with not much force, which proves that long positions are still strong. Don't blindly chase shorts!

If the MACD indicator shows that the green bars continue to shorten and turn into red bars, it indicates that the long positions are strengthening; if the KDJ indicator forms a golden cross and diverges upwards, it further indicates that the bearish strength is insufficient.

Suggestion: Long positions at 114500-114000, target 116000, if it breaks, look towards around 118000!

If the MACD indicator shows that the green bars continue to shorten and turn into red bars, it indicates that the long positions are strengthening; if the KDJ indicator forms a golden cross and diverges upwards, it further indicates that the bearish strength is insufficient.

Suggestion: Long positions at 114500-114000, target 116000, if it breaks, look towards around 118000!

BTC-0.98%

- Reward

- like

- Comment

- Repost

- Share

ETH, from a 4-hour perspective, the MA10 daily moving average is strongly pumping, the BOLL bands are showing a fluctuating upward trend, and the upper band continues to move upwards, indicating a long positions trend, but the price may also be constrained by the upper band.

-The overall trend of the MACD indicator is leaning towards oscillating upwards. Although there is a decrease in volume for ultra-short-term long positions, it is still in a relatively strong area, indicating that the strength of long positions has not completely exhausted.

Suggestion: Buy near 3590, target 3800!

-The overall trend of the MACD indicator is leaning towards oscillating upwards. Although there is a decrease in volume for ultra-short-term long positions, it is still in a relatively strong area, indicating that the strength of long positions has not completely exhausted.

Suggestion: Buy near 3590, target 3800!

ETH4.07%

- Reward

- like

- 1

- Repost

- Share

Shahbazahmad519 :

:

gate io is the best crypto exchangegate io is the best crypto exchangegate io is the best crypto exchange