What is Spark (SPK) — The Rising Star of Decentralized Finance

Preface

In the crypto space, whenever a new token or protocol launches, the community immediately scrutinizes whether it has real substance and a compelling narrative. Spark (SPK) is a decentralized finance (DeFi) project that has recently drawn significant attention—not just another hype-driven token, but a project that represents ongoing exploration and implementation of open finance in Web3.

What Is Spark?

Spark (token symbol: SPK) is a community-driven DeFi ecosystem built for resilience, transparency, and decentralized governance. Its main goal is to disrupt centralized financial institutions’ monopoly over capital and trust. SPK powers the platform’s liquidity, governance, and incentive mechanisms and serves as the essential value hub for the ecosystem.

Unlike some DeFi protocols that focus on a single use case, Spark aims to build a diverse, modular application framework. It encompasses yield farming, decentralized lending, and DAO governance models.

Core Functional Modules

- Modular Architecture: Spark’s modular design enables developers and the community to create custom features as needed, much like building with DeFi “legos.”

- Decentralized Governance: The platform is governed by a DAO, giving all participants the ability to shape protocol development through voting, which reflects Web3 decentralization principles.

- Multi-Chain Support: SPK will support multi-chain deployment, ensuring seamless interactions and expanded use cases across Ethereum, Arbitrum, Polygon, and more.

Tokenomics and Distribution

Spark has set a fixed total supply, which it distributes as follows:

- Community Liquidity Incentives: 45%

- Founding Team and Advisors: 20% (vested annually)

- Ecosystem Fund and Partners: 15%

- Public Sale/IDO: 10%

- DAO Treasury: 10%

This structure ensures the community remains in control, while providing ample resources for the platform’s long-term growth.

Core Utilities of the SPK Token

- Governance

SPK holders can propose and vote on changes, shaping platform upgrades, fee structures, liquidity pool allocations, and more. - Incentives

Liquidity providers can stake SPK to earn rewards, incentivizing the community to maintain stable liquidity across the platform. - Payments

Certain DeFi modules or cross-chain transactions may require SPK as part of gas or settlement fees.

Advantages and Potential

- Challenging Financial Monopolies

SPK promotes open, permissionless financial protocols, enabling trustless interactions and reducing the barriers and control traditionally held by legacy financial institutions. - Innovative Yield Models

From stable yield strategies to novel liquidity pool designs, SPK aims to improve capital efficiency and help manage risk. - DAO-Driven Innovation

Looking ahead, SPK governance enables proposals for new features, such as NFT-collateralized lending, on-chain insurance, and more modular applications.

Risks and Considerations

While SPK’s architecture is promising, investors should note that the project remains in an early stage. Governance and security are still developing, and there are potential risks related to its smart contracts and cross-chain bridges. SPK’s price can be highly volatile. Investors should assess their risk tolerance before participating.

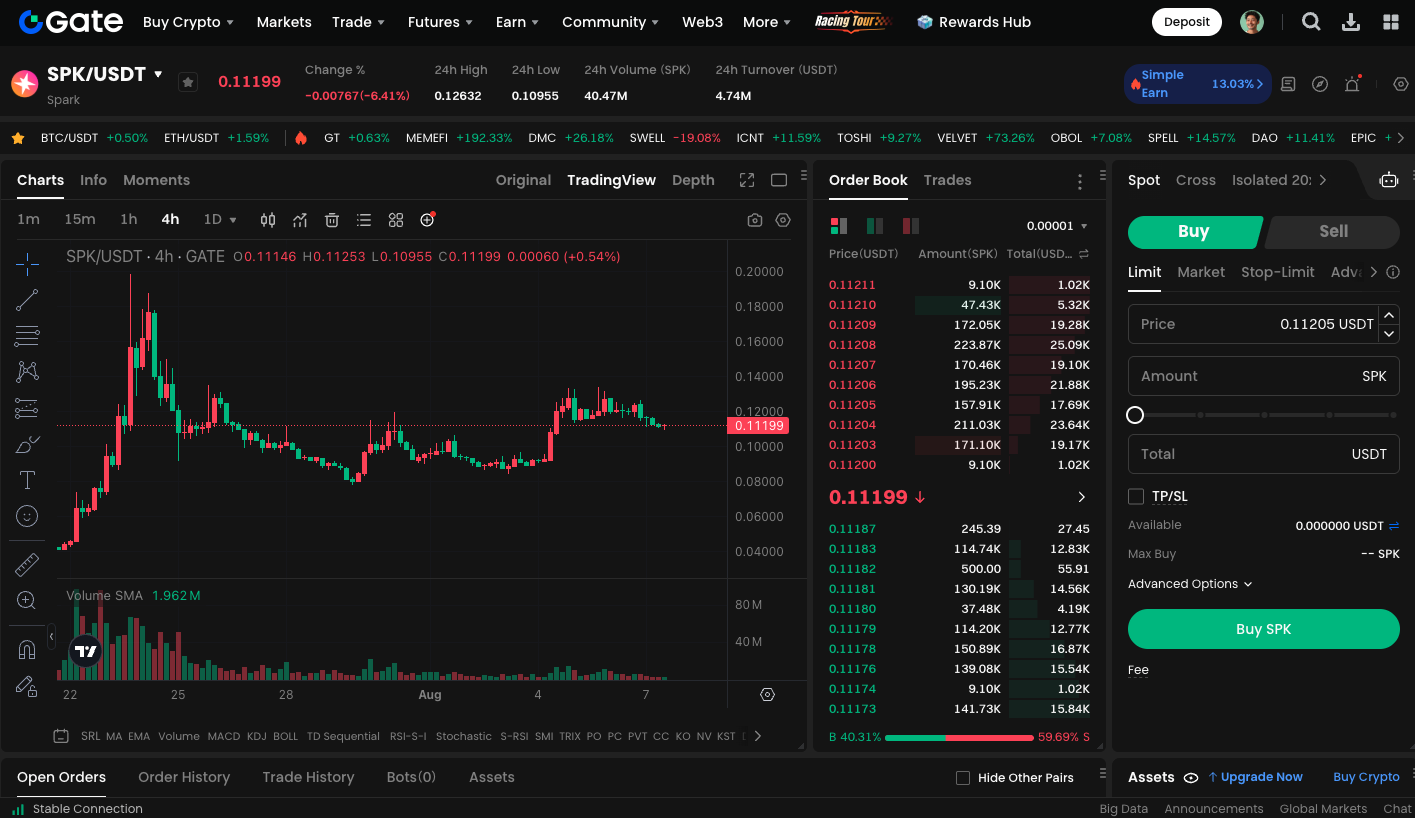

https://www.gate.com/trade/SPK_USDT

Conclusion

As a new DeFi protocol, Spark (SPK) showcases a strong commitment to decentralization and modular innovation. As the DeFi ecosystem continues to evolve, Spark may play a significant role in the next wave of financial transformation.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025